Call Monday-Friday 9am - 6pm Closed Saturday & Sunday

[ Contact Us ]

Need Help? Calling from a mobile please call 0151 647 7556

0800 195 4926Do you have a question? or need help?

Call Monday-Friday 9am - 6pm Closed Saturday & Sunday,

Vehicle Replacement GAP Insurance is probably the most comprehensive level of GAP cover available in the UK today. This is because it has a higher potential payout than Return to Invoice or Lease & Contract Hire GAP. This is because equivalent car prices can go up. If you buy a brand new car today, then the cost of the equivalent brand new car in three years could be much higher.

However.....

Not all Vehicle Replacement GAP policies are created equal. Some only cover the cost of a like-for-like replacement, and may not factor in your original invoice price or finance settlement. It may also not account for a situation where the equivalent replacement vehicle is no longer available.

That’s where Total Loss GAP stands out.

Why Total Loss GAP VRI is different:

Unlike many Vehicle Replacement GAP '3-in-1' policies, our version pays you the highest of:

Plus if the equivalent replacement vehicle is no longer available, we can cover the original invoice price plus an extra 10% in value. Where others simply revert to the price you first paid, you still get an added advantage with Total Loss GAP, where the model is no longer made.

This way, you're guaranteed the best possible outcome if your car is written off, no matter how you bought it.

Get the best GAP Insurance available in the UK today.

You may expect the cost of an equivalent vehicle to increase, but nothing is guaranteed. If you buy a brand new car today, then the brand new equivalent in the future could be much more expensive to replace.

However, in some circumstances, the future replacement cost could be less. Rare, but it could happen. Let's say you bought a brand new model out in the market. You may have paid the full price, with no discounts, as the manufacturer was not providing any on a new model. In the future, the cost could have come down if the manufacturer is now offering big discounts because it is bringing out a new model.

In this case, if you have VRI GAP Insurance from Total Loss GAP, and you made a claim, then you can still get the highest settlement, as we can revert to the original invoice price you paid, IF that is more than the replacement cost when you make a claim.

Other VRI products in the market may provide you with the reduced replacement cost instead, meaning you could lose out on thousands of pounds in settlement.

What is the equivalent replacement cost? - this cost, at the time you claim, the same age, mileage and specification model as the day you first bought it.

So if your vehicle was brand new at purchase, then the equivalent brand new model when you claim.

If your car was year old with 10,000 miles when you bought it, then its the one year old, 10,000 equivelent when you make your claim.

Another key advantage of choosing our Vehicle Replacement GAP (we call it Combined Invoice and Replacement GAP) is that it eliminates the need to choose between Return to Invoice GAP, Finance GAP, and Vehicle Replacement GAP.

These three types of GAP Insurance are often available to car buyers, but the best option is not always clear.

With Total Loss GAP '3-in-1' Vehicle Replacement GAP, you simply get the best of all three.

In the event of a claim, our VRI GAP can top up the motor insurer's settlement in one of three ways:

One policy combining three GAP Insurance types guaranteed the best outcome available.

Our Total Loss Combined Return to Invoice and Vehicle Replacement Policies have the following features as standard.

* if your motor insurance excess is higher, then you would be liable for any amount over £250.

Navigating the world of motor insurance can be a challenging and confusing task.

That's why understanding the different types of insurance available to you is essential. Many believe that a simple, fully comprehensive motor insurance policy is as much as you can do to protect yourself.

However, this is not the case, and relying on your car insurer's settlement to replace your vehicle could leave you out of pocket. Why? Because comprehensive car insurance may only cover the current market vehicle value when you claim. If that results in the vehicle being written off by your motor insurer, the amount they offer could mean that you could be left with outstanding finance to pay, AND you need to replace it, too.

Here, we will delve into the policy details, exploring how it works and can complement your motor insurance coverage, as well as the key differences and advantages compared with other types of GAP Insurance coverage.

An example of how a VRI Claim would be settled.

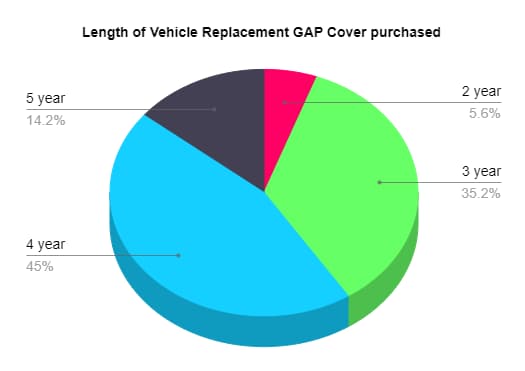

We would only ever recommend buying a policy for the length of time you hope to keep your vehicle. We say this because you are only eligible for cover during the first 180 days of ownership. Thus, you would no longer be eligible at the end of your policy. While we can offer alternative cover, it is nowhere near as comprehensive as a VRI policy. During a sample data set, most of our policyholders purchased four-year policies, followed by three years, with the remainder being split ( although slightly weighted ) between 2 and five years.

.png)

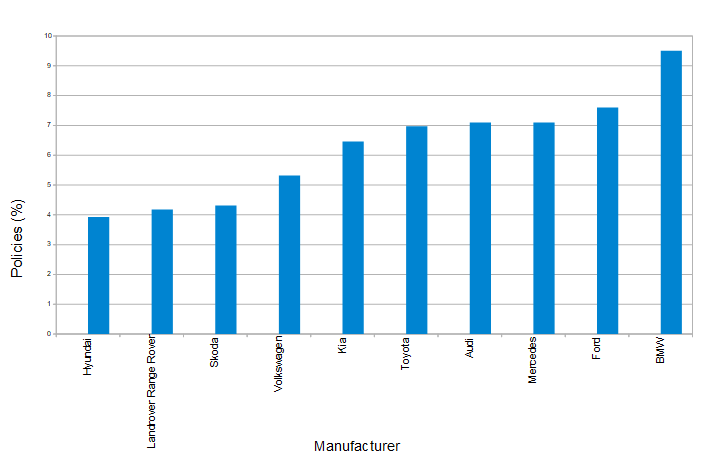

We provide a lot of vehicle replacement policies to BMW owners and the least amount to Lotus owners.

We have supplied Total Loss Vehicle Replacement policies covering over 40 manufacturers from Abarath, Jeep, and Mann to Volvo. The data set was so large that displaying it was impossible. Instead, we have chosen to show our top ten manufacturers.

We hope this shows that no matter what vehicle you have, you can benefit from knowing that should the worst happen, you have the peace of mind of knowing that your policy will perform.

( Data taken from Total Loss Vehicle replacement policy sales between July and October 2023 shown as a percentage)

There are several types of GAP Insurance available, but two main types are:

Some key differences between Vehicle Replacement GAP Insurance and these other types of return to invoice GAP insurance and finance or contract hire GAP insurance:

Vehicle Replacement GAP Insurance offers a range of benefits, including:

All named drivers over 18 years of age with a full UK licence named on your fully comprehensive motor insurance policy.

Vehicle Replacement GAP Insurance may be better and more comprehensive than Return to Invoice (RTI) GAP Insurance in certain situations. Here are some reasons and examples of where Vehicle Replacement GAP cover can be a better option:

1. Protection against increased vehicle prices

Vehicle Replacement GAP covers the cost of a brand-new replacement vehicle of the same make, model, and specifications as your original car, even if the price of the new vehicle has increased since you bought your car.

For example, let's say you bought a car for £30,000, and after a few years, its market value depreciated to £20,000. This is what your motor insurer pays. If the price of a new, equivalent car has increased to £35,000 due to factors like inflation, market fluctuations, or increased demand for new cars, Vehicle Replacement GAP Insurance would cover the £15,000 difference, allowing you to purchase a new, equivalent vehicle without additional out-of-pocket expenses.

In contrast, RTI GAP Insurance would only cover the £10,000 difference between the market value (£20,000) and the vehicle's outright original purchase price (£30,000), leaving you with a £5,000 less in settlement to cover the increased cost of the new car.

2. Coverage for discontinued or updated models

If your car's specific make and model has been discontinued or significantly updated since your purchase, Vehicle Replacement GAP Insurance can be beneficial. In this case, the insurance will cover the cost of a new, equivalent vehicle that is closest in specifications and features to your original car.

In contrast, RTI GAP protection only covers the difference between the market value and the original purchase price. This claim amount may not cover the cost of a new, equivalent vehicle with updated features or a newer model.

In summary, Vehicle Replacement GAP can be a better and more comprehensive option than RTI GAP Insurance in various situations. It provides better protection against increased vehicle prices, offers comprehensive coverage for vehicles with significant depreciation, and ensures coverage for discontinued or updated models.

There are many GAP products bearing the name Vehicle Replacement GAP. However, they can be very different in how they can cover you. Buying this type of GAP Insurance from Total Loss GAP can provide you with several advantages.

These include:

3 in 1 cover - A combined Invoice and Replacement GAP is our product. This means that Total Loss VRI GAP Insurance can protect you, if your vehicle is declared a write-off or theft, between the motor insurer settlement and the HIGHER of:

If the original price you paid exceeds the replacement cost, you do not lose out. In that circumstance, we will revert to the higher invoice price you paid instead of the lower replacement cost.

This may not happen often in a claim, but knowing you are getting the best possible outcome is good. You also do not need to choose between a Return to Invoice GAP and a Vehicle Replacement GAP when you buy your vehicle. This policy takes the guesswork away.

Cash settlement - Our VRI policy provides a cash settlement. Unlike others, we do not seek to supply your next car for you or dictate what car you get next. Cash settlements give you the choice of what you drive next.

Additional protection for discontinued models - If your car's manufacturer stops production in the future, it can be impossible to calculate the replacement cost of your vehicle. Other VRI products would revert to the original invoice price you paid. However, we feel that is not giving you full value for a replacement cost, as you have bought the policy expecting the replacement cost to increase. So, with Invoice and Replacement GAP from Total Loss GAP, if no equivalent replacement vehicle is available, your settlement will be based on an extra 10% on top of the original invoice price you paid for the vehicle.

A nationally recognised GAP product - Total Loss GAP, has been featured on many consumer and car owner websites. It is also the current (as awarded in 2021) AutoExpress 'Best Buy' for GAP Insurance in the UK.

When you compare a Total Loss GAP VRI GAP with other providers, please do not assume you get all these benefits and features. It could be a costly mistake in the event of a claim!

There can be an assumption that any GAP product bearing the Vehicle Replacement name will be the same. In reality, this is not the case, and if you are not careful, picking the wrong one could mean a difference of thousands of pounds in a claim.

What do you need to look for?

There are a couple of aspects to check here. Firstly, how will the insurer make the VRI settlement to you? There are a couple of ways this can be done.

There are a couple of further issues to consider with the second option. If you have been in an accident or were considering changing the vehicle as it does not suit your needs, being forced into a replacement may not be ideal. Also what happens to any finance settlement?

The second issue comes when you refuse the offer of a replacement vehicle of the insurer's choice. If you do this, they may reduce your settlement to the original invoice price you paid for the original car. If you compare this to a VRI policy that pays out a payment for the replacement vehicle in cash, you may lose thousands of pounds in your settlement.

Vehicle manufacturers can discontinue models, which leaves an issue in determining what replacement costs are used in a settlement. Again, some VRI products will revert to the original invoice price you paid with no direct replacement available.

However, we offer an added advantage and value at Total Loss GAP. If there is an equivalent replacement vehicle to use to calculate the replacement cost, then with a Total Loss GAP Invoice and Replacement GAP (our version of VRI), we will add 10% to the invoice price you originally paid.

This is an extra 10% payment, in cash, that you would not get from other VRI products that only used your original invoice value.

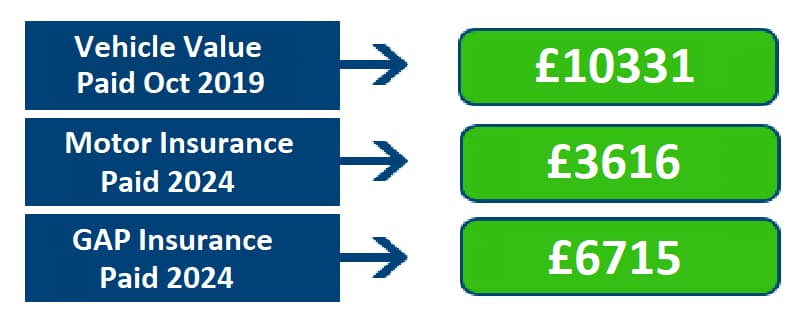

Real-life Total Loss Vehicle Replacement GAP Insurance 2024 Claims data

Vehicle Replacement GAP vs Return to Invoice GAP - what is the difference?

In conclusion, a Vehicle Replacement GAP policy is an excellent option for car owners who want to ensure they can replace their vehicle with a brand new car (or an equivalent replacement car if used) in the event of a total loss or theft.

VRI GAP coverage offers protection against depreciation, financial security, and peace of mind, making it a valuable addition to your overall car protection package.

By understanding the key differences and advantages compared with other GAP Insurance policies, we hope you will have all the information you need to make an informed decision and choose the best policy for your needs.

Find out all about GAP Insurance through our comprehensive knowledge hub.