Call Monday-Friday 9am - 6pm Closed Saturday & Sunday

[ Contact Us ]

Need Help? Calling from a mobile please call 0151 647 7556

0800 195 4926Do you have a question? or need help?

Call Monday-Friday 9am - 6pm Closed Saturday & Sunday,

A GAP Insurance quote is an estimated price for a policy that can cover the difference between your car’s value and what you owe, originally paid or its replacement cost if it's written off or stolen.

It’s tailored to your vehicle, your finance type, and the level of coverage you choose.

Getting a GAP quote at the right time is crucial. Most providers only allow you to take out cover within a limited window after you’ve bought the vehicle, often within 30 to 180 days. You may lose eligibility or face higher premiums if you wait too long.

A quote gives you a clear picture of your options and helps you avoid overpaying at a dealership. The sooner you get one, the better your choices.

You could have a financial shortfall if your car is stolen or written off. Your car insurance may only cover the already depreciated 'market value'. That’s where a GAP Insurance quotation comes in.

By getting a quote online, you can:

Save money compared to costly dealership GAP policies

Protect yourself from rapid depreciation, especially with new or financed cars, if the vehicle is written off or stolen

Ensure your car finance is covered, whether you bought with PCP, lease, HP, or cash

This guide will walk you through:

What information you’ll need

How to compare GAP Insurance the smart way

The most common mistakes to avoid

If you want straightforward car finance protection or to protect the money you have invested, that gives you peace of mind; this is where to start.

A GAP Insurance quote is a personalised price estimate based on your car’s value, how you bought it (cash, finance, lease), and how long you want the coverage to last.

It’s important to understand that a quote differs from a bought policy. A quote gives you an idea of the cost and cover options available. It becomes an active policy once you accept the quote and provide payment.

You can usually get a GAP quote within 30 to 180 days of purchasing your vehicle, though this timeframe can vary depending on the provider and type of policy.

Whether financing a new car or buying one outright, knowing how to get a GAP quote in the UK ensures you make an informed choice and avoid overpaying through a dealer.

The best time to get GAP Insurance is just before you've purchased your car. Most providers allow you to take out cover within 30 to 180 days of the purchase date, depending on the policy type and whether the vehicle is new, used, or pre-registered.

Getting a quote before you get the car, or even before you order the car, can give you a good feel for your options and costs.

Getting a quote early has other key advantages:

Wider choice of cover types (Return to Invoice, Vehicle Replacement, Finance GAP, Lease GAP)

Lower premiums, as some policies are cheapest when taken out shortly after purchase

Avoid ineligibility, especially if your car’s mileage increases quickly or the purchase window closes

Your eligibility and the quote you receive are influenced by:

The start date of your finance agreement

The car’s invoice price and depreciation rate

Whether the car is brand new, used, or on a lease

Can you get GAP Insurance after buying a car?

Yes, but only within a specific timeframe. Once that window closes, you may no longer qualify for cover, or only limited options will be available.

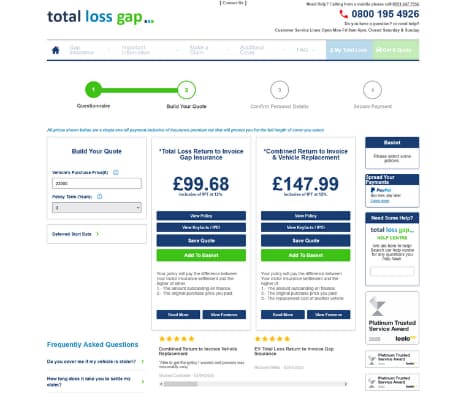

Getting a quick GAP Insurance quote from TotalLossGAP.co.uk could not be easier. The whole process should take you less than 5 minutes and will give you a good idea of what GAP Insurance cover may be available.

The process is as follows:

Visit TotalLossGap.co.uk, click 'Get a Quote' and choose 'GAP Insurance' from the options.

Answer some eligibility questions on things like how you bought your vehicle (finance, PCP, lease, cash etc), vehicle use, age, mileage etc

You will then reach the quote page. You will be asked to put in the price you paid for the vehicle (this is the net invoice price, not the RRP or pre-discounted price), or the monthly rental payment if you have a lease.

Select level of cover (you may be offered more than one GAP Insurance policy type) and duration in years

Select any optional extras like deposit protection for a lease, or a deferred start date for a new car with replacement cover, should you wish.

Your quote for GAP Insurance is provided, as a total premium for the term chosen, including Insurance Premium Tax.

Click 'Add to basket' and then 'Checkout' to buy the policy or save quote to email or text you a link.

And that is it, seven easy steps to get a GAP Insurance quote online in under five minutes.

Getting a quick quote will help you understand your options better and help you make an informed choice on Guaranteed asset protection cover.

Our simple GAP Insurance calculator will generate your quote based on the information you provide. Please make sure what you enter is as accurate as possible to get an accurate quotation.

To get an accurate GAP Insurance quote, you'll need to provide a few key details about your vehicle and how you purchased it. Having this information ready will speed up the process and ensure the quote you receive is as accurate as possible.

Car manufacturer and model

Some vehicles have a higher risk (sports, performance or some prestige vehicles) so you may need to confirm the make and model.

Vehicle purchase price

Usually the invoice price you actually paid or on-the-road price, not the list price or what you think the car is worth.

Purchase date

The date you bought the car from the dealer, or the date your lease started if on contract hire.

Current mileage

This helps determine eligibility and may affect your cover options.

Finance type

Whether the vehicle was bought using PCP, HP, lease, or outright with cash. Please note PCP and PCH are very different. If on a Personal Contract Purchase (PCP) then you can own the vehicle. With Personal Contract Hire (PCH) you can't. Different types of GAP Insurance are appropriate in each case.

Vehicle status

Whether the car is new, used, pre-registered, or an ex-demo model.

What do I need for a GAP quote?

Just a few details, usually what’s on your invoice or finance documents. With the right info, you can get a quote online in under 30 seconds.

If you’ve ever wondered “Why do GAP Insurance quotes vary?”, the answer lies in several key factors that influence the price you’re given.

Type of GAP Cover

There are different types of GAP Insurance, such as: Return to Invoice, Vehicle Replacement, Contract Hire and Lease GAP and Agreed Value GAP (for vehicles bought privately). Each may cover a different risk

Vehicle Value

The higher the invoice or purchase price of your vehicle, the more the potential pay out, so the premium is typically higher.

Vehicle Age and Mileage

Newer vehicles with lower mileage usually attract better rates. Older or high-mileage cars may reduce the types of GAP cover available and increase the cost.

Finance Type and Term Length

Whether you're using PCP, HP, or leasing the vehicle will influence the policy type and quote. Longer finance terms or leases may also raise the premium.

Claim Limit and Optional Extras

Some policies allow you to choose a higher claim limit or add extras like cover for dealer-fitted accessories, negative equity, or voluntary excess protection. These all affect the final quote.

Where you buy GAP Insurance cover

It is generally accepted that buying GAP Insurance from your motor dealer will be more expensive than if you buy independently. More on that below.

How much is GAP Insurance?

It can vary from under £100 to several hundred pounds depending on your car, cover level, and policy duration. Getting a tailored quote online is the best way to find the right price for your situation.

Finding the best value GAP Insurance provider for your needs means typically comparing what your motor dealer may offer against what you can find online. Some general points you may find:

Getting a quote for GAP Insurance might seem simple, but several common mistakes can lead to overpaying, buying the wrong cover, or ending up with a policy that doesn’t properly protect you.

Here’s what to check in a GAP quote before you commit:

Using the wrong vehicle value

Many drivers mistakenly use the RRP or list price instead of the invoice value they paid. This can skew the quote (you could end up paying more than you need) and affect the payout if you claim.

Choosing the wrong type of GAP cover

Not all GAP policies are the same and may work for different circumstances. For example, Return to Invoice (RTI) and Vehicle Replacement Insurance (VRI) work for vehicles you can buy (so cash, HP, PCP). Contract & Lease Hire GAP work with vehicles for which you have a fixed-term rental agreement (Contract Hire but NOT a hire car). Make sure the type matches your purchase or finance method.

Ignoring exclusions and claim limits

Always check the maximum claim limit, policy duration, and any excluded scenarios (such as certain types of finance, vehicles, or usage, such as delivery or taxi use).

Compare products, not just prices.

This is hard because we all want the best deal possible. However, not all products called 'GAP Insurance' are the same. Basic Finance GAP Insurance typically provides far less cover than Return to Invoice or Vehicle Replacement GAP. Even when two products from different providers have the same name, the features and cover can differ. Compare GAP Insurance quotes AND features to find the best deal. The GAP Insurance cost is important, but what you are covered for should also be carefully checked.

Not understanding the policy terms.

Failing to read the terms and conditions could leave you uncovered when you need it most. Look out for cancellation rules, admin fees, and excess clauses. For example, if you claim on GAP Insurance, some people think.

Avoiding these GAP Insurance quote mistakes can save you money, and help you get the right protection the first time.

A number of factors can impact a GAP Insurance premium. The purchase price or value of the vehicle, the length of coverage you want, and the type of GAP Insurance cover you choose are the three main factors that can affect the premium quoted.

Premium prices for GAP Insurance from Total Loss GAP range from around £80 for a 3-year Return to Invoice policy to over £1,000 for a 5-year Replacement style policy for a higher-risk SUV like a Range Rover.

It is commonly understood that the cheapest way to buy GAP Insurance in the UK is from an independent provider, like Total Loss GAP, rather than from a motor dealer.

Why? There are several reasons.

A GAP Insurance policy is subject to tax. Rather than VAT, Insurance has a different type of tax called Insurance Premium Tax. To complicate matters further, there are two levels of insurance premium tax. The standard rate, currently 12%, is charged when you buy independently from the car dealer. The higher rate of 20% is what you pay if you buy GAP cover from the vehicle-supplying car dealer.

This is a choice for you. You will undoubtedly have a comprehensive car insurance policy in place. If the car is written off or stolen, however, your motor insurer may only cover the car's current market value at that time, the already depreciated value of the vehicle, not the amount you originally paid.

You may have outstanding finance. You will also have to replace the vehicle. Taking the settlement figure from your motor insurance policy may leave you short.

A GAP policy means you can top up the market value settlement from your comprehensive motor insurance policy. This can help you pay off your car loan or lease or put you in a better position to replace your car.

So, do you need GAP Insurance? No, as it is not a legal requirement. Is GAP Insurance worth it? That is your choice.

Yes, GAP Insurance coverage is available for new and used cars. Some providers allow coverage for vehicles up to 8 years old when you buy the car, and some allow coverage for vehicles up to 10 years old. There may also be a maximum mileage limit.

Again, it is not normally a requirement that you have GAP cover for your lease. However, it may make sense to get some if you are concerned about any shortfall on your lease settlement should the car be written off or stolen. A GAP Insurance quotation could also include cover for your advanced rental.

Yes, most GAP cover products can be purchased after you get the vehicle. But be aware there are limits on on getting a quotation as most policies require you to purchase within 90, 180 or even 365 days after the vehicle collection.

Insurers can change rates and quotes, but you should see a quote that is valid for 10 to 14 days.

Ensuring you have the correct GAP cover starts with getting your quote right. It is important you get the right cover, no more or no less than you need.

Knowing what information you need prior to getting your GAP Insurance quote is the key to success. Using the simple, online quotation system at Total Loss GAP will give you a good idea of your choices and the premium you should expect to pay.

If you have any doubts, or you need some help, then please feel free to call our award winning customer service team who will be more than happy to help you get your quote right.

Looking for more information on GAP Insurance? See our GAP Insurance guides hub for the most in-depth GAP Insurance resource on the internet in the UK.