Call Monday-Friday 9am - 6pm Closed Saturday & Sunday

[ Contact Us ]

Need Help? Calling from a mobile please call 0151 647 7556

0800 195 4926Do you have a question? or need help?

Call Monday-Friday 9am - 6pm Closed Saturday & Sunday,

Combined Return to Invoice GAP Insurance is designed to protect the original invoice price you have paid for your vehicle. In the event of a total loss, it will pay the difference between your insurance company's settlement and the higher of either:

The outstanding finance.

The original invoice price you paid.

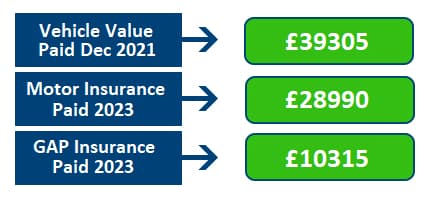

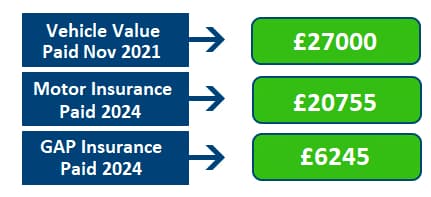

Due to depreciation, your vehicle could be worth much less than the price you paid in just a few years. The average vehicle may lose as much as 50% over a three-year term, with some particular models losing more. This means that if your vehicle is written off, the amount that your motor insurer offers you in settlement could be many thousands of pounds less than you paid or have as an outstanding finance balance.

*New from October 2025 – Total Loss GAP can offer you a range of Return to Invoice products from a number of different insurers, all of whom carry an 'A' credit rating.

The quote you are provided with will be based on the best premium price for the quote you request.

Having a panel of insurers allows us to provide Return to Invoice GAP quotes for vehicles up to £150,000 in purchase value.

All of the current insurers carry a 'A' credit rating from at least one of the three globally recognised credit reference agencies (Standard and Poor's, AM Best and Fitch). This means they have been independently assessed for their financial strength and stability, and the award of an 'A' rating indicates they are the most secure option for your cover.

Given the economic uncertainty at the current time, using a 'A' rated insurer, as opposed to an unrated insurer, gives you a best chance that your insurer will be able to pay any claim quickly, and in full.

Some other providers use unrated insurers, who whilst they may have the necessary solvency requirements to be able to trade in the UK market, have not submitted themselves to an independent assessment by the credit agencies mentioned above.

Please note, each insurer may have slightly different terms and conditions, claim limits, transfer and cancellation options, etc. These will be detailed in the IPID (the summary) and the full Terms and Conditions available at the quotation and confirmation pages, and you will be provided with these if you complete a purchase. The underwriting insurer will also be detailed on these documents.

Please ensure you check these terms are suitable for your needs. If you have any queries please do not hesitate to ask us for clarification.

For more on our current insurers please check our Insurers and Plan providers page.

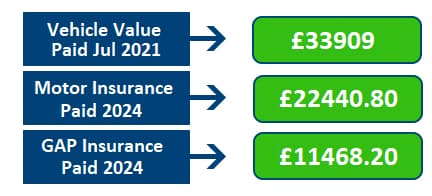

Let's look at an illustrative example.

Without any form of GAP insurance or having to use your savings or potentially commit to extra borrowing, your motor insurer's settlement is the only amount you have to be able to replace your car or clear any outstanding finance.

A Total Loss Combined RTI GAP Insurance would pay the difference between your motor insurance company's market value settlement and the original purchase price. This means you now have the full purchase price of £24,000 between your two insurance companies.

If you recently purchased a vehicle, you will most likely be offered a form of RTI GAP insurance from your motor dealer, which can be called many different names.

.jpg)

We are proud of our Combined Return to Invoice GAP Insurance policy.

However, please remember that not all GAP policies are the same; some will have slight variations that can have a huge impact on your claim and, ultimately, how much you can claim.

We have worked hard with our underwriting team to ensure our policies are as inclusive and simple as possible. However, every policy will have terms and conditions, and it is important that you understand them. This is because it shows how your claim will be calculated and settled.

Return to Invoice is usually the type of GAP protection most dealerships offer. However, if you conduct some research, you will find more forms of GAP for you to consider. We are all different. We spend various amounts on vehicles, fund them in different ways, and use them for various reasons. So why should one level of cover be the most appropriate policy for everyone?

You can opt for our Total Loss GAP Combined Invoice and Replacement GAP. This can cover you to the HIGHER of either the replacement cost of another vehicle the same as yours was on the first day you drove it home, or the original invoice price you paid. This is our premier policy and eliminates the choice between taking a Return to Invoice cover or Vehicle Replacement GAP. The policy gives you the best outcome between the two.

We do offer a second option.

If you like the idea of a simple Return to Invoice policy, we can offer that to you as well (from August 2020). Like our premier product, other than not having the replacement element of cover, you still have unlimited cover between your motor insurer settlement and the original invoice price you paid for the vehicle.

Both RTI and VRI GAP Insurance are suitable for both new and used cars.

Both Return to Invoice and Vehicle Replacement GAP products can be used with cash buys as well as HP and PCP finance agreements.

| Feature | Return to Invoice (RTI) | Vehicle Replacement (VRI)** | Finance GAP |

|---|---|---|---|

| What it covers | Difference between insurer payout and original invoice price | Difference between insurer payout and cost of equivalent replacement | Difference between insurer payout and finance balance |

| Includes finance settlement? | Yes - if higher than invoice | Yes - if higher than invoice or replacement cost | Yes - up to the outstanding finance balance |

| Covers rising car prices? | No | Yes | No |

| Applies to cash buyers? | Yes | Yes | No |

| Typical payout limit | Up to invoice price | Can exceed invoice if replacement cost is higher | Up to remaining finance balance |

| Best for | Fair-priced new or used purchases | Discounted cars or those likely to increase in price | Finance customers with high loan balances |

| Availability | Within 180-365 days of purchase | Within 180-365 days of purchase | Within 180 days of finance start |

| Covers discontinued models? | Yes - pays invoice amount regardless of availability | Yes - fallback to invoice + 10% if no equivalent | Yes - covers finance regardless of model availability |

In summary:

** 3-in-1 VRI GAP available from Total Loss GAP. Not all VRI GAP products will be as comprehensive.

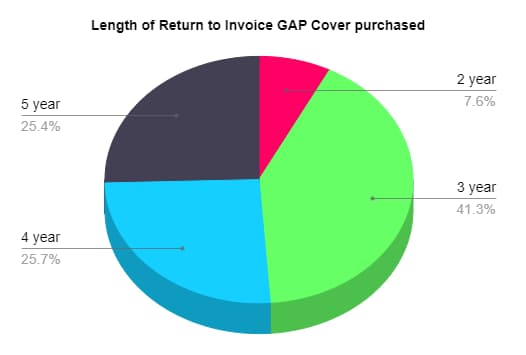

We are often asked this question, so we thought we would show you what our policyholders have been buying in the last six months. You will see that only a few policyholders buy a two-policy. The vast majority buy a 3 three policy. Please note currently we offer between two and four year GAP Insurance options.

There are two other options, the first being the most basic form of protection. This one is simply designed for you to clear any outstanding finance and you walk away with no liability. But, you walk away with nothing. The other level of cover, is the most comprehensive type, rather than you being returned to the invoice price you have paid for the vehicle, instead, we top you back up to the cost of a 'like for like' replacement vehicle at that moment in time. If you purchased a brand new vehicle, the settlement will be based on another brand new vehicle, which due to inflation and changes in exchange rates, etc, is likely to be more than the price you originally paid.

With a Total Loss GAP Combined Invoice and Replacement GAP, we combine all three different types, and whichever element provides the highest settlement, at the point of write off. This means that, at the very least, we guarantee to return to you the original invoice price you paid for the vehicle, as Return to Invoice GAP Insurance would do. However, the cost of a replacement vehicle may have increased, resulting in the settlement being higher than the original invoice price you paid. If you have any outstanding finance attached to the vehicle, the finance is cleared within any settlement, and the equity and balance left over is yours to do as you wish.

You may also like: The different types of GAP Insurance - explained simply

.jpg)

.jpg)

.jpg)