Call Monday-Friday 9am - 6pm Closed Saturday & Sunday

[ Contact Us ]

Need Help? Calling from a mobile please call 0151 647 7556

0800 195 4926Do you have a question? or need help?

Call Monday-Friday 9am - 6pm Closed Saturday & Sunday,

We completely understand that customers want to know that the insurance policy they buy from Total Loss Gap works. The key aspect of that is that claims are paid and customers are able to then replace their vehicle and get back on the road.

Looking at our claims data from April 2019, we have seen that the average claim on a Total Loss Gap Combined Invoice and Replacement Gap policy was £9,177.80

Picking through the claims we have also been able to highlight three claims that show just how much a policy can pay out even after a relatively short period of cover.

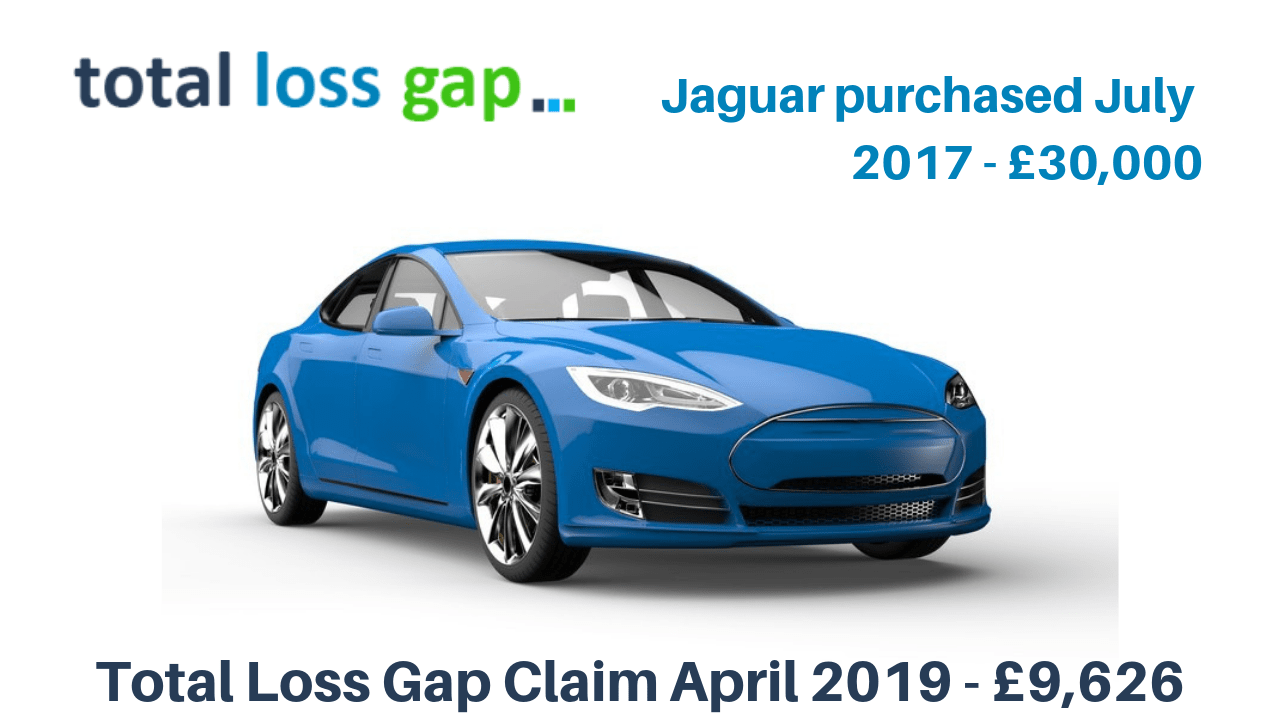

Vehicle bought : Jaguar XE

Purchase Price : £30,000

Vehicle Purchased : July 2017

Claim date : April 2019

Time on cover : 21 months

Claim agreed : £9,626

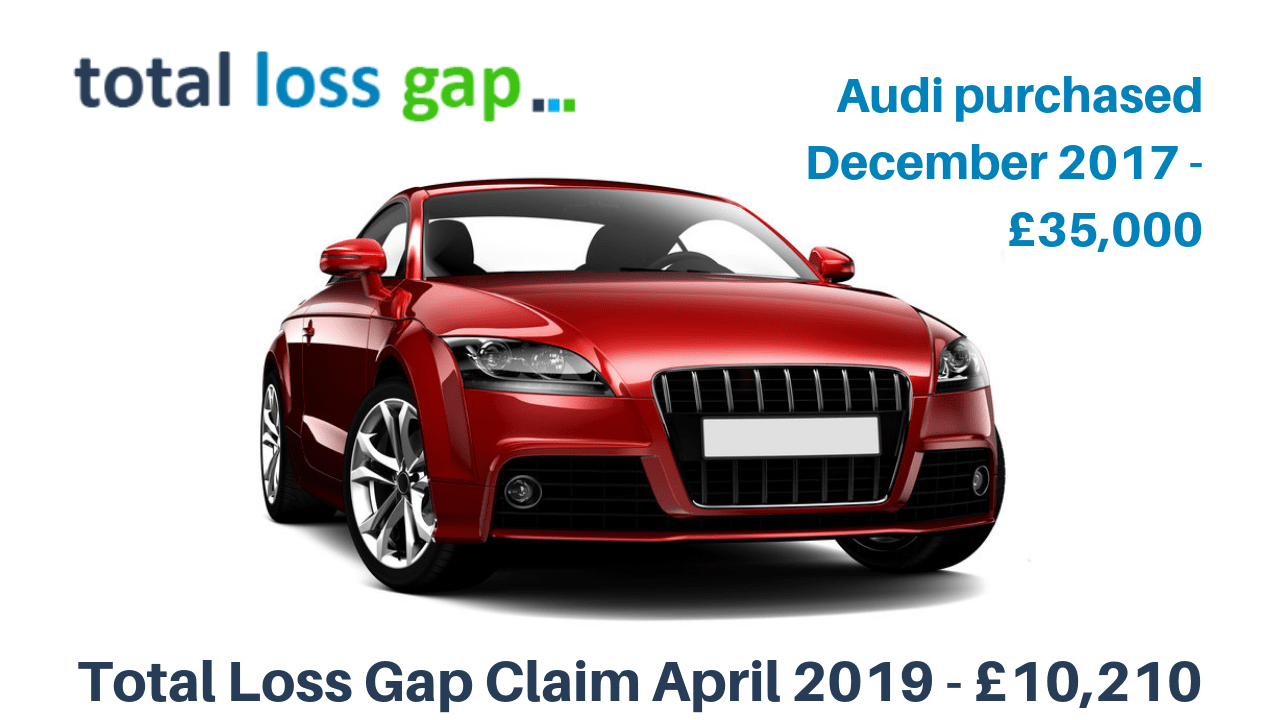

Vehicle bought : Audi TT

Purchase Price : £35,000

Vehicle Purchased : December 2017

Claim date : April 2019

Time on cover :17 months

Claim agreed : £10,210

Vehicle bought : BMW 335d X-Drive

Purchase Price : £41,739

Vehicle Purchased : November 2017

Claim date : April 2019

Time on cover : 18 months

Claim agreed : £23,685

When you consider that all three of these vehicles had not reached two years on cover then you can see that significant claims have been settled in each case.

Remember the amount you can protect, and indeed claim back, with a Total Loss Gap Combined Invoice and Replacement Gap can be higher than with other Gap Insurance products.

We take into account both the invoice price you originally paid and also the cost of the replacement at the time you make a claim. Whichever is the higher is what we can cover you back to.

If you take a typical Return to Invoice Gap often provided through a motor dealer then these are often restricted to the price you paid only. This can lead to a lower Gap Insurance claim settlement to you.

These factors can explain why you can see such large settlements paid on our products, even when the customer have only had the policy for a relatively short period of time. Something we hope will provide reassurances to our customers and all considering using Totallossgap.co.uk to protect them.