Call Monday-Friday 9am - 6pm Closed Saturday & Sunday

[ Contact Us ]

Need Help? Calling from a mobile please call 0151 647 7556

0800 195 4926Do you have a question? or need help?

Call Monday-Friday 9am - 6pm Closed Saturday & Sunday,

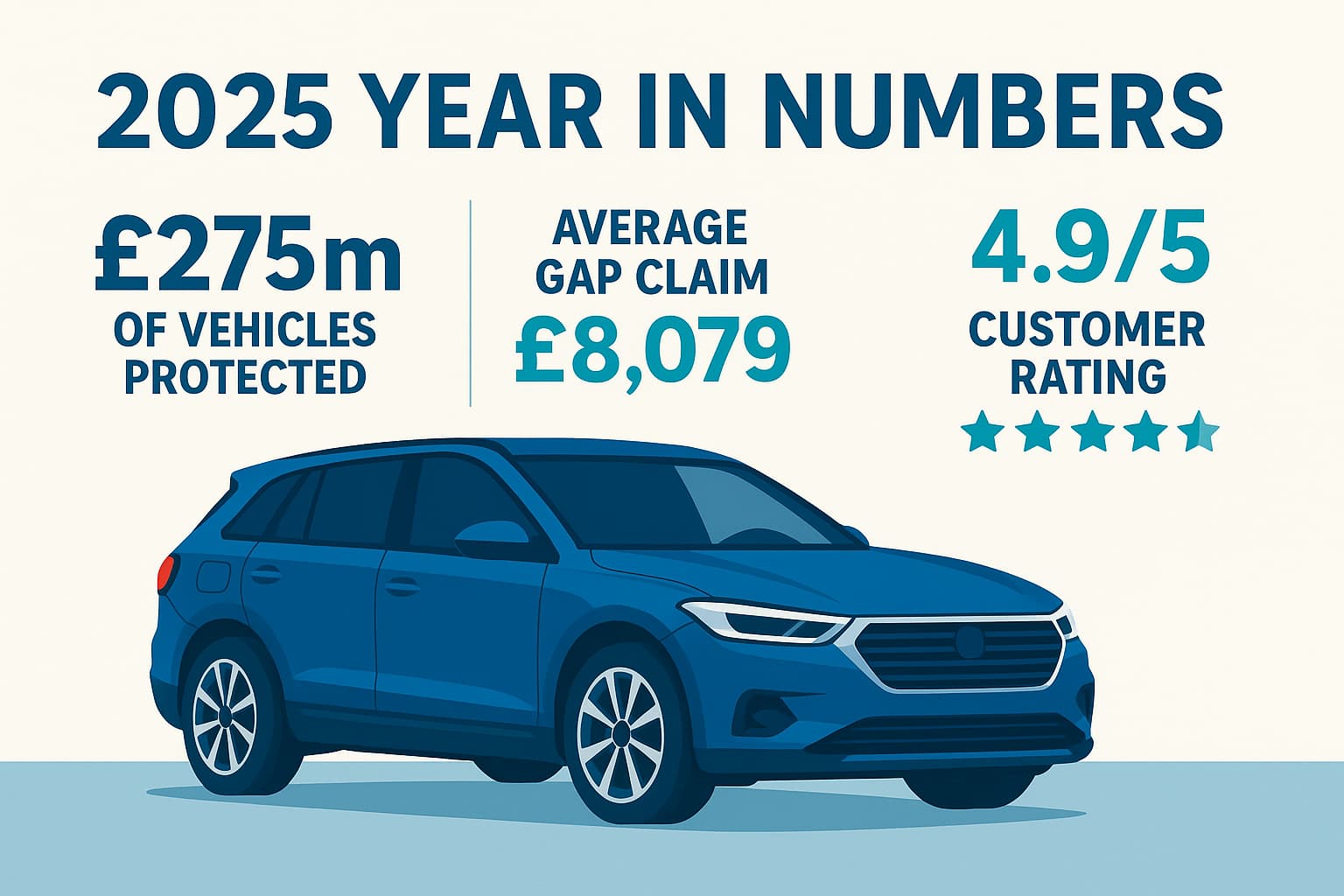

As 2025 comes to an end, it seems the perfect time to reflect on how the year has evolved in terms of events, achievements and milestones for us at Total Loss GAP.

Let's start with some headline numbers.

It is with some pride that we see UK consumers have trusted us to provide GAP Insurance cover for vehicles with an accumulative value of nearly £275,000,000.

We have been providing GAP Insurance to customers since 2010, so many of these customers are people returning to us, sometimes for the fourth or fifth time. We are also pleased to see a good proportion of new customers choosing Total Loss GAP as their GAP Insurance provider.

Our average GAP Insurance claim rose to £8,079.19 in 2025, the highest level in the last six years.

Our largest claim settled in 2025 was £35,945. (See When having the best GAP Insurance pays off)

Whilst it may be too early to say why our average claim has risen, several factors have come into play.

Firstly, we offer comprehensive levels of cover that ensure more of a potential loss can be covered. Whilst many only offer the basic Return to Invoice cover, we also provide our 3-in-1 'best in class' Combined Vehicle Replacement and Invoice GAP. As this is specifically designed to provide the best settlement, this can mean more money for you.

Secondly, car prices have reportedly dropped over the last couple of years, following a period of higher used-car prices during Covid. This means that people who bought GAP Insurance at the market high will see larger claims now, simply because car prices have fallen.

Cars protected by our policies started at £5,000 and climbed to £148,620, showing we aren't talking about one type of buyer or one type of vehicle.

Total Loss GAP also saw a record 69 different vehicle manufacturers covered by customers who took out cover with us. From the traditionally popular brands like BMW, Audi, Volkswagen, Ford and Mercedes-Benz, we see strong representation within the policies we have sold. However, we have also seen a surge in newer brands, particularly those with strong electric car ranges, such as MG, Jaecoo and BYD, driving significant policy sales.

The audience was broad. Hatchbacks and SUVs, financed cars, leased cars, and quite a few prestige motors carrying rare upgrades, custom alloys, and the kind of tech that costs a fortune when it's bundled into a write-off settlement.

We live in uncertain financial times. That is the same for an insurance company as it is for any business. For this reason, Total Loss GAP now only provides GAP Insurance cover from a panel of 'A' rated insurers.

So what does this mean for you?

Insurers can be classified into two financial categories: rated and unrated. A rating of 'A' means that they have been independently financially assessed by one of the world's leading credit rating companies as having the highest financial stability and strength.

Unrated insurers, whilst still solvent, may not have the same resilience to financial shocks.

Having your policy underwritten by an 'A' rated insurer means that you have a better chance that the insurer will be there when you need them, i.e. when you make a claim and need the money settled to prevent a financial shock to your finances.

Our customers constantly ask us for car insurance quotes. You asked, so we listened. In September, we launched our own car insurance comparison service, providing access to over 120 car insurers, including Admiral, Hastings Direct, RAC, Direct Line, and many more.

The system is provided by comparison experts at Seopa Ltd, and is one of the first of several comparison facilities we hope to launch in the next year.

We understand that budgeting is increasingly essential in everyday life in the UK. This is why Total Loss GAP has introduced more options for how you can pay for cover with us.

These include the introduction of Apple Pay and Google Pay facilities.

We have expanded our 'pay monthly' options, also with the option of a 'buy now, pay later' 6 months at 0%, with no credit checks.

We also offer a range of longer-term, traditional premium credit agreements of up to 48 months. This can allow those on a tighter budget to get GAP Insurance for as little as £2.58 per month.

The company behind Total Loss GAP, Aequitas Automotive Ltd, had its 15th birthday in August 2025.

How time flies.

In that time, we have protected hundreds of thousands of customers and billions of pounds' worth of vehicles. We have been discussed, mentioned and featured on the likes of Which?, MoneySavingExpert, WhatCar, AutoExpress, PistonHeads, and many more.

Our customers have seen millions of pounds paid out in claims and have saved significant sums compared to what they may have expected to pay at motor dealers.

Total Loss GAP continues to save customers money by not appearing on comparison websites or by not paying for 'star ratings', 'recommendations' or affiliations. Inevitably, if we did, then you would end up paying for these costs in the premium you pay.

Reviews are key for all businesses. By listening to all, good and bad, we can ensure our systems and processes remain aligned with providing the best possible service. .png)

The average customer rating for 2025 held at 4.9 out of 5 on verified review platforms. Customers like the validation because they know these are real policyholders leaving verified feedback.

For this task, we engage a company called Feefo, who only send review requests to our verified customers. This way, we can avoid 'rogue' reviews from customers of other brands or an unscrupulous competitor trying to sully our reputation (it has happened!).

Our Feefo score of 4.9 out of 5 rates us as 'Exceptional' for the service we provide, something we take some pride in.

Here is a recent example of a review left on Feefo, from one of our long-time customers, Mr Andrew Clarke :

We have exciting new plans for 2026. We will be exploring new products and markets to give our customers even more rounded vehicle protection.

Total Loss GAP is never one to rest on its laurels.

We want to thank all our customers for their continued support and look forward to what Total Loss GAP can achieve in 2026.