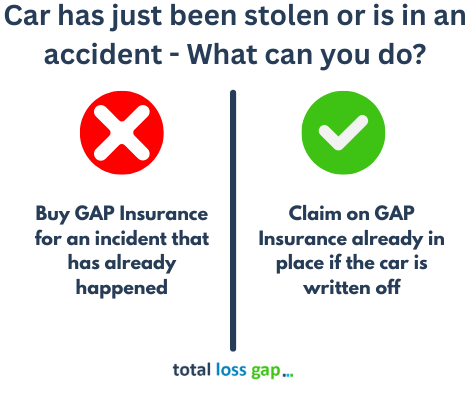

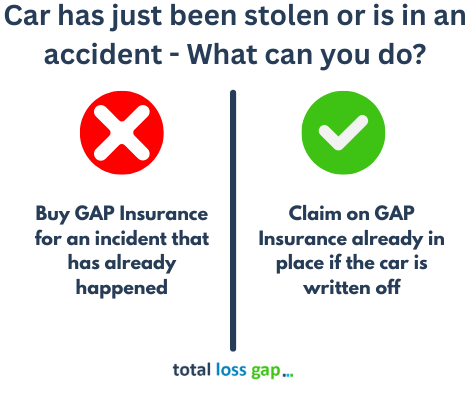

Can You Buy GAP Insurance After an Accident or Theft?

You cannot buy GAP Insurance after an accident or theft has already happened. Cover must start before the incident.

Why GAP Insurance Can’t Be Bought After the Event

GAP Insurance is there to cover a possible future loss. It has to be in place before the risk exists.

When a theft or accident has already occurred, the outcome is no longer uncertain. From an insurer’s point of view, the dice have already been rolled.

This isn’t a policy loophole or a technical exclusion. It’s a basic rule of insurance and applies across the market.

When Is It Considered “Too Late”?

This is where much of the confusion comes from.

- The vehicle has been stolen and reported to the insurer.

- The vehicle has been involved in an accident likely to result in a total loss.

- An engineer’s report points towards a write-off

- Your motor insurer has indicated the car will be written off.

- A total loss valuation has been issued.

You do not need to have accepted the settlement for this rule to apply.

The trigger is the incident itself, not the payment date.

“But the Insurer Hasn’t Confirmed the Write-Off Yet…”

We hear this a lot.

From the driver’s perspective, everything still feels up in the air. From an insurer’s perspective, it usually isn’t.

Once the accident or theft has happened, GAP insurers treat the risk as known. Even if the final decision is pending, cover cannot be added after the fact.

Waiting for confirmation does not reopen the window.

What If the GAP Policy Is Already in Place?

This is the important distinction.

If you already had GAP Insurance before the accident or theft, then a claim should be valid, provided the policy terms are met.

In that situation:

- The timing works in your favour.

- The GAP claim runs alongside the motor insurance claim.

- The policy responds to the shortfall, not the accident itself.

This is exactly the scenario GAP Insurance is designed for.

Why You’ll See Conflicting Advice Online

Some articles suggest, wrongly, that you can buy GAP Insurance “before the write-off is agreed”. That wording is misleading.

In real-world claims handling, insurers look at:

- The date of the incident

- When the risk became known

- Whether the policy was in force at that point

If the incident came first, the cover won’t apply.

What You Can Do Instead

If your car has already been stolen or is likely to be written off, GAP Insurance isn’t an option at this stage. However, you may still be able to:

- Challenge your motor insurer’s valuation.

- Provide evidence of a higher market value.

- Check whether finance settlements are being handled correctly.

- Claim for uninsured losses where applicable.

These steps can make a real difference to the final figure.

A Quick Clarification

This page deals only with cars that have just been involved in an accident or theft.

If you are asking a different question, for example, whether you can buy GAP Insurance for a car that was written off in the past and repaired before you bought it, that is a separate issue, but the answer may be the same.

We cover that scenario in a dedicated guide.

The Bottom Line

You cannot buy GAP Insurance after an accident or theft has already happened, even if the write-off has not yet been finalised.

That’s why timing matters, and why arranging cover early is so important.